Added: 16 May 2023

Updated: 25 February 2026

Everyone of working age on the above benefits will have to move over to Universal Credit (UC). The process is called a ‘managed migration’ - it is the final phase of the roll out of UC.

You can stay on them for now unless you get a migration letter from the Department for Work and Pensions (DWP) telling you to claim Universal Credit by a certain date.

The DWP will start to write to households receiving the following benefits and start to issue migration letters to make a claim for Universal Credit. When you receive your UC Migration Notice letter from the DWP you need to act.

You will have three months to make a claim for UC (the dates will be on your letter), at the end of the three months your legacy benefits will stop.

You will need to consider within the three-month period when it would be the best time for you to make the claim to ensure you protect and maximise your income - PLEASE DO NOT ASSUME YOU ARE NOT ENTITLED TO UC, if you are in one of these groups – self-employed, people with savings, have childcare costs, or a part-time worker – please seek advice on your individual circumstances to ensure that you can maximise your income.

Please seek advice to make sure you don’t lose out on what you are entitled to.

Getting the right advice before changing to Universal Credit

For advice, contact the DWP UC Migration Notice Helpline on 0800 169 0328 (calls are free from mobiles and landlines), they are open Monday to Friday, 8am to 6pm.

You can also call the Citizens Advice Bureau (CAB) Help to Claim Advisors on 0800 144 8 444. The CAB Help to Claim phone service is free to use and is open 8am to 6pm, Mon to Fri.

You can read a step-by-step guide about UC migration from Citizens Advice here

Guidance for people who have received a Migration Notice from gov.uk

Information from DWP gov.uk - Tax credits are ending - Understanding Universal Credit

Help from Torus:

If you are still unsure and would like to talk to us, contact the Torus Income Services Team or Torus Foundation and they will be able to offer you advice about making a UC claim, or they offer you a referral to the Citizen’s Advice.

Torus customer, you can access free benefits support from Citizens Advice. Contact them directly on 0808 279 7840. They are taking enquiries from Torus customers across all areas, so make sure they know you’re with Torus.

Find out more and get in touch

Nationally, organisations that support people often have helplines that may be able to offer support and advice, for example CarersUK, Working families, Advice Local (for details of independent advice organisations) and Money Helper says ‘If you’re on Universal Credit or think you might be using it in the future, our Money Manager tool can help guide you’.

Some people/households will be better off when you move across, but some people will not. Be sure to get advice before you switch as you cannot go back once you have moved across.

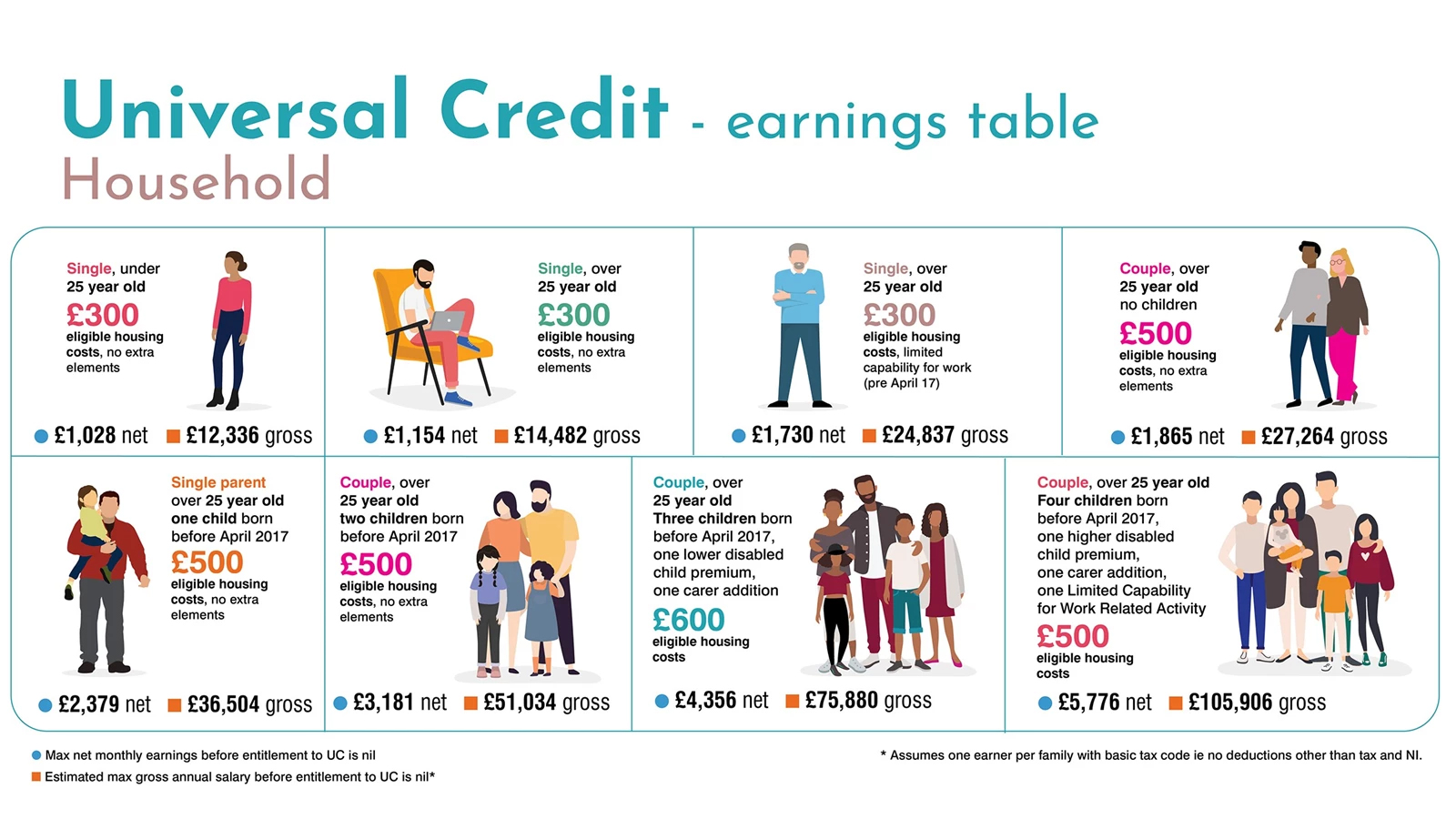

If you are working and not in receipt of any Universal Credit, but are unsure if you would qualify, the table below gives a few examples of different family circumstances and the levels at which you would still qualify for Universal Credit:

You can also try a Benefits Calculator to help you figure out what you may be entitled to.

You can also prepare for this switch by making sure that you have the following readily available when you apply online:

- your bank, building society or credit union account details

- an email address

- access to a phone

- your housing costs

- your landlord details

If you are claiming tax credits and are aged 65 or over, the DWP will write to you to ask you to apply for Universal Credit or Pension Credit, depending on your circumstances.

What's happening and what to do

The DWP is gradually notifying people on legacy benefits that these are ending, inviting them to apply for Universal Credit (UC) by a specified deadline. This notification is called a Migration Notice letter. Claimants will not be automatically moved to UC and must apply themselves.

Timeline for receiving Migration Notice letters

When you receive your UC Migration Notice letter, read it carefully and do not ignore it. You must claim Universal Credit within the deadline specified (typically within three months). Seek advice before applying. Your legacy benefits will generally stop three months after receiving the Migration Notice.

The DWP has said the timetable to complete the process of ending legacy benefits and moving claimants over to UC is by the end of 2026.

The DWP timeline for migration can be found below:

| Your current benefit

|

When you may get your Migration Letter

|

| Tax credits, only if you are below State Pension age

|

From March 2023

|

| Tax credits with Housing Benefit

|

From April 2024

|

|

Income Support (Income Support only, Income Support with tax credits, Income Support with Housing Benefit, Income Support with Housing Benefit and tax credits) Tax credits are closing in April 2025, it is important that you respond when you receive your Migration Notice letter. You will have three months from the date of your receiving your Migration letter to apply for UC. Do not take action until you receive your letter from the DWP, but you must make the claim within the three months or your benefits will stop. |

From April 2024

|

| Housing Benefits only

|

From June 2024

|

| Income-related Employment Support Allowance (ESA), with Child Tax Credits

|

From July 2024 |

| Tax credits (if you are of State Pension age and are asked to move to Pension Credit)

|

From July 2024

|

| Tax credits (if you are of State Pension age and are asked to move to Universal Credit)

|

From September 2024

|

| Employment and Support Allowance (ESA) only

|

From September 2024

|

| Employment and Support Allowance (ESA) with Housing Benefit

|

From September 2024

|

Transitional Protection

If the amount you are entitled to on your existing benefits is more than you’ll get on Universal Credit, a top up is available. This is called a‘ Transitional Protection’ payment.

You can only get this top up if you have received a migration letter and claim by the deadline date on your letter. If you are affected by the benefit cap, i.e. you receive the maximum amount of benefits that is allowed in the UK, then you are not entitled to transitional protection.

If you are concerned, please get in touch with us or contact Citizen’s Advice on 0800 144 8 444.

Build a rent account buffer

One way you can get ready for the swap to Universal Credit is, if you can, start to build some credit on your rent account.

Universal Credit is paid in arrears and if you can pay a little bit extra towards your rent account now, it will be in a healthier position when the move to Universal Credit actually happens.

Remember, we’re here to help. So if you want to speak to someone, get in touch.

Managed Migration FAQs

These FAQs have been designed to answer some common questions about Managed Migration. It has been split into the sections below to make it easier to navigate. If you have any questions, or have received a Migration Notice telling you to make a claim for Universal Credit, please get advice, see above.

- General

- Migration Notices and deadlines

- Will I have to claim Universal Credit?

- Will I be entitled to Universal Credit?

- How do I make a claim for Universal Credit?

1. General FAQs

Managed Migration is the final phase of the rollout of Universal Credit (UC). The Department for Works and Pensions (DWP) will send those who are still claiming legacy benefits, listed above, a Migration Notice.

This is a letter notifying them that their legacy benefit entitlement is due to end and inviting them to claim UC instead.

In 2023/24, only claimants receiving Tax Credits will receive Migration Notices. Claimants receiving the other legacy benefits, will start to receive Migration Notices at a later date.

Universal Credit is a benefit for working aged people designed to simplify the welfare system. It combines the six legacy benefits into one single payment. It is designed to give you a minimum level of income based on your individual circumstances. It is for people who are working, looking for work, or unable to work due to an illness / disability or caring responsibility.

The six legacy benefits are: Working Tax Credit, Child Tax Credit, Housing Benefit, Income-Related Employment and Support Allowance, Income Support, and Income-Based Jobseekers Allowance.

You should only need to claim Universal Credit if you have been sent a Migration Notice or have a change in your circumstances that would normally mean you would be looking to make a new claim for one of the benefits that Universal Credit is replacing. Always get advice (see above) before making a claim for Universal Credit – even if you think you will be better off.

As long as you provide all the necessary evidence, attend your new claim interview, agree your claimant commitment, and complete all the to-dos and actions the DWP have asked you to complete, then you should receive your first payment around 5 weeks after you claimed.

If you need help whilst waiting for your first Universal Credit payment, once you have verified your ID, then you can request an Advance Payment of your Universal Credit. This is an advance of your future award and so you will pay it back over time through deductions from your on-going Universal Credit payments.

Universal Credit is a monthly benefit. You will receive your Universal Credit payments on or around the same date every month.

Once you know what this date will be you may want to start thinking about when your regular payments go out of your bank account and swap around some of those dates.

The date of your first payment cannot change, but the DWP can then pay you more frequently.

Explain the difficulties you are going to have to your work coach. If agreed the DP usually pay half of your UC award on your normal pay day and then the other half 14 or 15 days later.

The Tax Credits system is closing down and being replaced by Universal Credit. If you receive a Migration Notice, then this letter with give you the date that your Tax Credits are due to end. Staying on Tax Credits is not an option. If you are unsure about Universal Credit and would like to know more about it, then always get advice (see above).

HMRC are closing down Tax Credits so you will not be able to continue receiving support in this way. Once you are chosen for Managed Migration, the DWP will send you a letter - called a Migration Notice - and your Tax Credits will end whether you make a claim for Universal Credit or not.

2. Migration Notice and Deadlines

Contact the Universal Credit Migration Notice Helpline 0800 169 0328 Mon-Fri, 8am to 6pm, explain why you are going to struggle and request an extension. They can give you an extra 4 weeks in which to claim.

Your current Tax Credits award is set to end on that date and so your payments will stop. To continue to receive financial support you must make a claim for Universal Credit. If you are struggling to make your claim, the DWP can extend the deadline contact the UC Migration Notice Helpline 0800 169 0328 Mon-Fri, 8am to 6pm.

You can call the UC Managed Migration Helpline 0800 169 0328 Mon-Fri, 8am to 6pm and ask for an extension to your deadline. You should explain that you have only just started to engage with the migration process and need time to seek advice and organise your UC claim. They can give you an extra 4 weeks in which to claim. You need to make a claim for UC before your deadline – seek advice if you have time (see above).

If you need the financial assistance Tax Credits have given you then you will need to make a claim for Universal Credit. If you make your claim within a month of your deadline, your UC claim will be backdated and there will be no gap between your Tax Credits ending and UC starting (and you could still be entitled to any Transitional Protection you are entitled to). If it is over a month since your deadline, there will be a gap in your entitlements, and you will not be entitled to Transitional Protection.

Yes. You can ring up the Universal Credit Managed Migration Helpline 0800 169 0328 Mon-Fri, 8am to 6pm and request a copy.

If it gives you a date by which you must claim Universal Credit, then it is a Migration Notice. At the bottom of each page of the letter it will state: ‘This is a migration notice issued under regulation 44 of the Universal Credit (Transitional Provisions) Regulations 2014.’ If you are still unsure, seek advice.

Yes. You can ring the Universal Credit Managed Migration Helpline 0800 169 0328 Mon-Fri, 8am to 6pm and they will use the reference number on the letter to work out if it is genuine.

If you have a received a Migration Notice, then you will need to claim Universal Credit before the date given. There may be a better time for you to claim i.e., either before or after the move, so contact us.

If, because of the move, you are going to struggle to make your Universal Credit claim by the date in your Migration Notice, contact the UC Migration Notice Helpline. Explain your situation and request an extension - they can give you an extra 4 weeks in which to claim.

3. Will I have to claim Universal Credit?

Claimants who receive a Migration Notice need to make a claim for Universal Credit by the deadline given in the Notice (although they can ask the DWP to extend this deadline if they will struggle to do so). If someone who receives a Migration Notice, then their Tax Credits are ending and payments will stop whether they make a claim for Universal Credit or not. In certain circumstances it’s possible for the DWP to cancel a Migration Notice – but this is rare.

HMRC have been including these leaflets in Tax Credit renewal packs as many working people are better off on Universal Credit. Unless you have received a Migration Notice the move is voluntary.

However, Tax Credits are ending and once you have been issued with a Migration Notice this replaces that leaflet. If you wish to continue to receive welfare support, you must make a claim for Universal Credit by the date in your Migration Notice.

If you receive a Migration Notice and there are less than six months before you turn State Pension

age, then contact the UC Managed Migration Helpline 0800 169 0328 Mon-Fri, 8am to 6pm, they may agree to cancel the Notice. You would then be able to stay on Tax Credits, although moving onto Pension Credit once you turn State Pension age may be a better option – get advice (see above).

4. Will I be able to make a claim for Universal Credit?

In most circumstances, if you receive a Migration Notice, you will be able to claim Universal Credit.

The DWP have introduced some Transitional Protections to ensure that some claimants who would not normally be entitled to claim UC will be able to if they receive a Migration Notice and make their claim by the deadline given (or agreed with the DWP if their deadline has been extended).

Universal Credit is designed to top-up your current income to a minimum level. This level depends on your individual circumstances. If you are currently receiving Tax Credits then it is likely that you will be entitled to the same amount, or more, from Universal Credit. If you claim Universal Credit after receiving a Migration Notice, there are certain ‘protections’ in place that mean you could be entitled to UC even if you normally would not be. Please get advice (see above).

Normally people with over £16,000 in savings/capital are unable to receive Universal Credit. However, special rules apply to Tax Credit claimants who have received a Migration Notice. As long as you apply by the given deadline, then you can have any savings/capital above £16,000 ignored for up to 12 months. Speak to a Benefits Adviser for more information. This is a form of Transitional Protection.

The rules around which students can claim UC are complex. Normally, a student in full-time advanced education can only claim if they have a non-student partner, are responsible for a child or they were found to have a Limited Capability for Work before starting their course.

However, if you receive a Migration Notice and claim UC by the given deadline, you will be entitled to UC whilst on your course even if you do not fall into one of the categories of students who can claim UC. Please get advice to get more information (see above). This is a form of Transitional Protection.

5. How do I claim Universal Credit?

Claims for Universal Credit are made online: www.gov.uk/universal-credit/how-to-claim

If you need help you can contact the Citizens Advice Help to Claim service.

If you are going to struggle making and maintaining an online Universal Credit account, then you may be able to have an offline claim – speak to a member of staff in your local Job Centre regarding this.

You will need an email address, bank account, and photo ID. If you do not have any of these, contact www.citizensadvice.org.uk/about-us/contact-us/contact-us/help-to-claim/, or seek advice (see above).

The claim form asks for details of you and your children/other people who live with you; details of your earnings, income, and savings; details of your rent and landlord. You should try to have this information ready when you make your claim.

IMPORTANT: Your Universal Credit claim is not made until you have completed all the sections and pressed ‘Submit’.

For your Universal Credit claim to be successful, you will need to do everything that appears on your ‘To-Do’ list – including attending a New Claim Interview and signing a Claimant Commitment. Failure to do anything on your ‘To-Do’ could lead to your claim being closed.

When someone makes a new claim for any benefit, the DWP need them to provide up to date evidence so they can ensure they are paying the right person the right amount of money.

All Universal Credit claimants need to attend a New Claim Interview and agree a Claimant Commitment. This is so the DWP can discuss your circumstances with you and – if appropriate – discuss what you will be required to do to receive Universal Credit. Many working claimants do not have to look for work – but still need to attend this first interview and sign a Claimant Commitment. Some UC claimants in work are still required to have regular contact with a Work Coach and search for more work. When considering how much you will need to do (if any), your Work Coach should consider your personal circumstances and anything that reduces the amount of time you can spend working (e.g. childcare / caring commitments, commuting etc). You should be prepared to discuss these things in your New Claim Interview.

For some people there will be a best time to claim. For exampleIf:

- You are a carer and the person you care for receives the Severe Disability Premium in one of their means-tested benefits, or

- On Universal Credit you could be affected by the Benefit Cap

Or, before the date given in your letter:

- You are expecting the outcome of a claim for Personal Independence Payment, or Disability Living Allowance (or similar benefit) for a member of your benefit family, or

- You will become a full-time advanced education student,

- Your savings/capital will go over £16,000,

- You are having a significant change in your circumstances, such as moving home or having a baby.

Please see advice before making a claim for Universal Credit, see above.

No. If you make a successful claim for Universal Credit by the deadline given in your Migration Notice and are entitled to some protection you will receive this automatically.

If you’re currently getting a legacy benefit, then you do not need to do anything unless you receive your Migration Notice, or have certain changes in your circumstances.

If you claim too early, then you may not receive the Transitional Protection (see above) you are otherwise entitled to.

If you are unsure when you will need to claim Universal Credit, then please speak to a Benefits Adviser.

Universal Credit (UC) Helper Tool - help for claimants

With the help of the Hyde Foundation, we have access to a Universal Credit Helper for our customers.

The helper provides a step-by-step guide for UC claimants, that helps them through the UC application process to reduce errors and delays. Looking to see whether they are eligible for UC through a UC benefits calculator. It also provides advice on the application process for Universal Credit.

Universal Credit (UC) helper tool

Should you need any assistance, please get in touch

In addition to the tool, we have these additional tips to help:

CREATE ACCOUNT

- Linking code: Only one partner needs to request the linking code, which the other partner can - they then give this to the other partner to input into the claim

MAKE THE CLAIM

- Things you’ll need – also your National Insurance number

- Under details of house - need to add Household composition – details of who lives with you in your house

- Make sure you include your housing costs, including service charges where applicable - even if your housing costs are covered by benefits, you still need to include these costs - it is NEVER zero (your housing costs are in your annual rent change letter, sent out annually, to all tenants each February)

- TOP TIP: Once claim made you have access to the UC dashboard which consists of three areas:

- Home Page: this is for making changes to your account

- To Do List: this needs to be checked daily and shows any actions you need to complete,

- Journal: this is for sending messages. Select ‘payments’ for queries about your payments, dates paid, questions on how to make changes. Select ‘work coach’ for questions about work, appointments and job searches.

VERIFY ID

- How long – 30 mins

- TOP TIP: Government Gateway Account if you don’t have one you can make one if you have the correct documents – can take another 10 minutes.

ATTEND INTERVIEW

- You do not call to arrange an interview.

- You need to check your to do list and most interviews will be booked for you by a work coach and the time and date will be on your to do list. This will also include the documents you need to bring in with you. The address of the jobcentre will also be in the to do list. Most first appointments are face to face and will be roughly an hour.

- If you have not had an appointment booked within a week of making the claim, then call 0800 328 5644.

- Take all the documents into the job centre with you – ID documents, fit notes etc.